A client came to me in a state of financial emergency. Their previous bookkeeper had made severe errors: accounts were unreconciled, payroll taxes were unpaid, excise taxes were ignored, and ServiceTitan was poorly integrated with QuickBooks Online (QBO). Invoicing was sporadic, extra work orders were overlooked, and there was no clear system to track or make tax payments. These problems combined to create a cash flow crisis that brought the business dangerously close to bankruptcy.

To turn things around, I performed a complete financial overhaul, methodically addressing each issue:

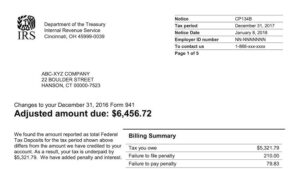

Communicating with Tax Agencies

I immediately reached out to the necessary tax agencies, explained the situation, and assured them that corrective action was underway. This helped avoid immediate penalties and secured extra time to implement the needed fixes.

Detailed Cleanup of QuickBooks Online (QBO)

I thoroughly reviewed and recategorized all transactions from the previous year to produce accurate and dependable financial statements.

Payroll and Workers’ Compensation Corrections

The entire payroll system was audited, ensuring all 28 employees were assigned correct workers’ compensation codes and other essential payroll information, helping fix compliance and tax reporting issues.

Sales Tax Setup and Correction

I verified and corrected sales tax setups in both QBO and ServiceTitan, making sure taxable transactions were properly tracked and reported.

ServiceTitan Integration with QBO

Proper integration between ServiceTitan and QBO was established, ensuring all transactions were accurately recorded and financial tracking became seamless.

Invoicing and Cash Flow Improvements

I built a system to ensure invoices, including extra work orders, were sent out promptly, improving cash flow and reducing missed revenue opportunities.

Establishing an EFTPS Account

An Electronic Federal Tax Payment System (EFTPS) account was set up for the client, enabling real-time tax payment tracking and on-time remittance.

Proactive Cash Flow Monitoring

I monitored cash flow closely to ensure tax obligations were met without disruptions, eliminating the risk of late fees and penalties.

Ongoing Financial Support

After the initial cleanup, I provided continuous monitoring and support, ensuring that the financial systems stayed clean and that the business remained on stable ground.

Thanks to the comprehensive financial cleanup and reconciliation, the client’s business was stabilized, and the threat of bankruptcy was eliminated. With accurate records, seamless systems, and proactive financial management in place, the business was finally positioned to operate efficiently and make strategic, informed decisions for future growth.

This case highlights how critical strong bookkeeping, regular reconciliation, and proper tax compliance are to a business’s survival. Without these foundations, even a thriving company can find itself in deep trouble.

If financial mismanagement or bookkeeping errors are putting your business at risk, don’t wait until it’s too late. With the right intervention — cleanup, compliance, invoicing systems, and tax management — you can not only survive but thrive. I’m here to help you restore and maintain your business’s financial health.